The Benefits of investing in a PIE Fund

Investing into a Portfolio Investment Entity (PIE) may provide a real benefit for some investors. This is due to lower tax rates being applied when compared to an investment that is subject to normal income tax rules. To explain a little further. The tax benefits are further enhanced for Senior Trust Capital investors due to tax shelters generated by equity investment in Retirement Villages .The combination of the tax shelters and Senior Trust Capitals PIE status results in the delivery of tax free return.

What is a prescribed investor rate (PIR)?

A PIR is the tax rate that your portfolio investment entity (PIE) uses to calculate the tax on the income from the investment of your contributions. The PIR is based on your taxable income, such as salary, wages and any other sources of income you would include in your income tax return. You’ll also need to include any income or loss attributed to you from your PIE when determining your PIR.

It’s important you provide your PIR and IRD number when asked for them. Your investment income will be taxed at the default rate of 28% if you do not provide them. This rate could be higher than your PIR.

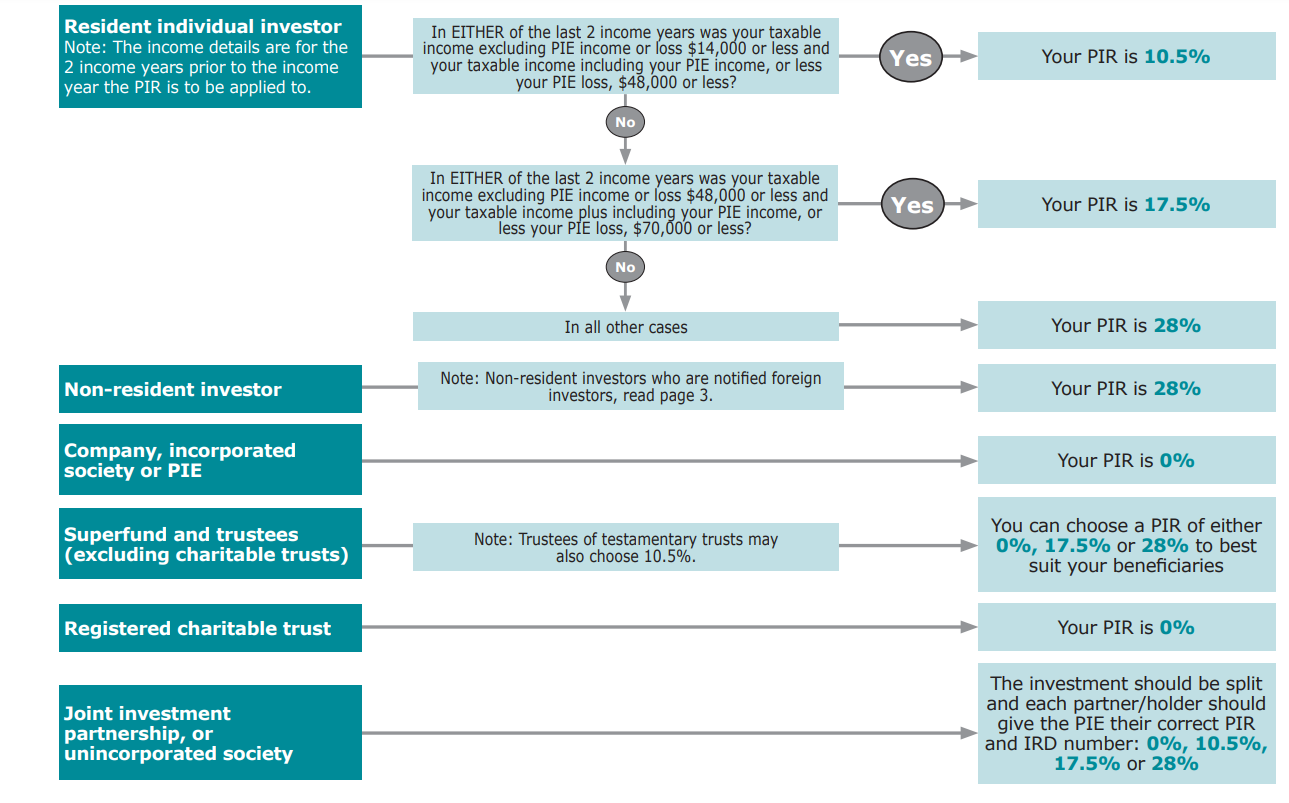

An overview of how it works:

The PIR for an investment in a PIE is determined by your previous two year’s income as follows:

A PIE investment can increase the amount of income that a 10.5% or 17.5% tax rate is applied to. If an investor is able to elect a PIR rate of 10.5% or 17.5% based on the last two years income, then PIE tax paid will be a final tax in the current year even though the current year’s income may be greater than the income thresholds. I.e. PIE income may be subject to PIE tax at 10.5% or 17.5% when the same income if earned from a non-PIE investment would be subject to tax at 30% or 33%.

Investors who have a marginal tax rate of above 28% will also benefit from 28% being the highest tax rate payable within a PIE.

Published: 11 July 2023

Disclaimer: Senior Trust Capital is not a Tax Adviser. The benefits of PIE will depend on each investor's personal circumstances. This information is of a general nature and we strongly recommend that you talk to your financial or tax adviser to determine if investing in Senior Trust Capital is right for you. Tax laws are subject to change and this article is based on legislation in effect on date published.

It is the responsibility of the investor to tell Senior Trust Capital of your PIR when you invest or if your PIR changes. If you do not tell us, a default rate may be applied. If the rate applied to your PIE income is lower than your correct PIR, you will be required to pay any tax shortfall as part of year-end tax assessment. If the rate applied to your PIE income is higher than your correct PIE, any excess tax will be used to reduce your income tax liability you may have for the tax year with any balance remaining refunded by Inland Revenue.